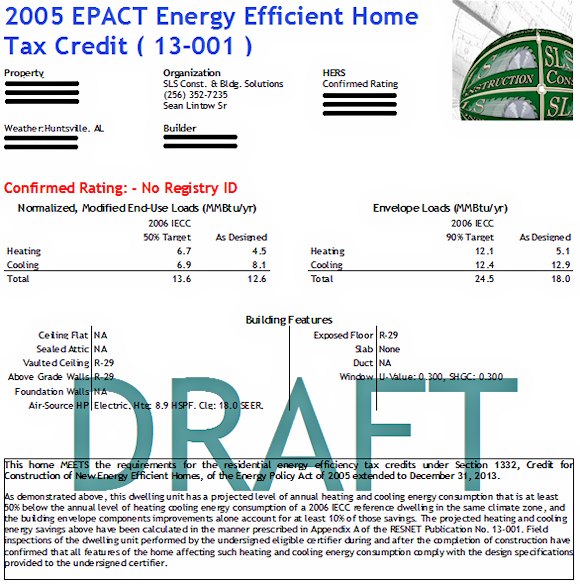

45l tax credit form

Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. The qualified contractor typically the developer builder or homeowner is the only person who can claim the 45L tax credit and must own the unit at the time of construction or improvement.

This Represents Inadvertent Because The Waiter Is Too Busy Looking At The Woman That He Accidentally Spills The Food On The Man Vocab Chapter Chapter 3

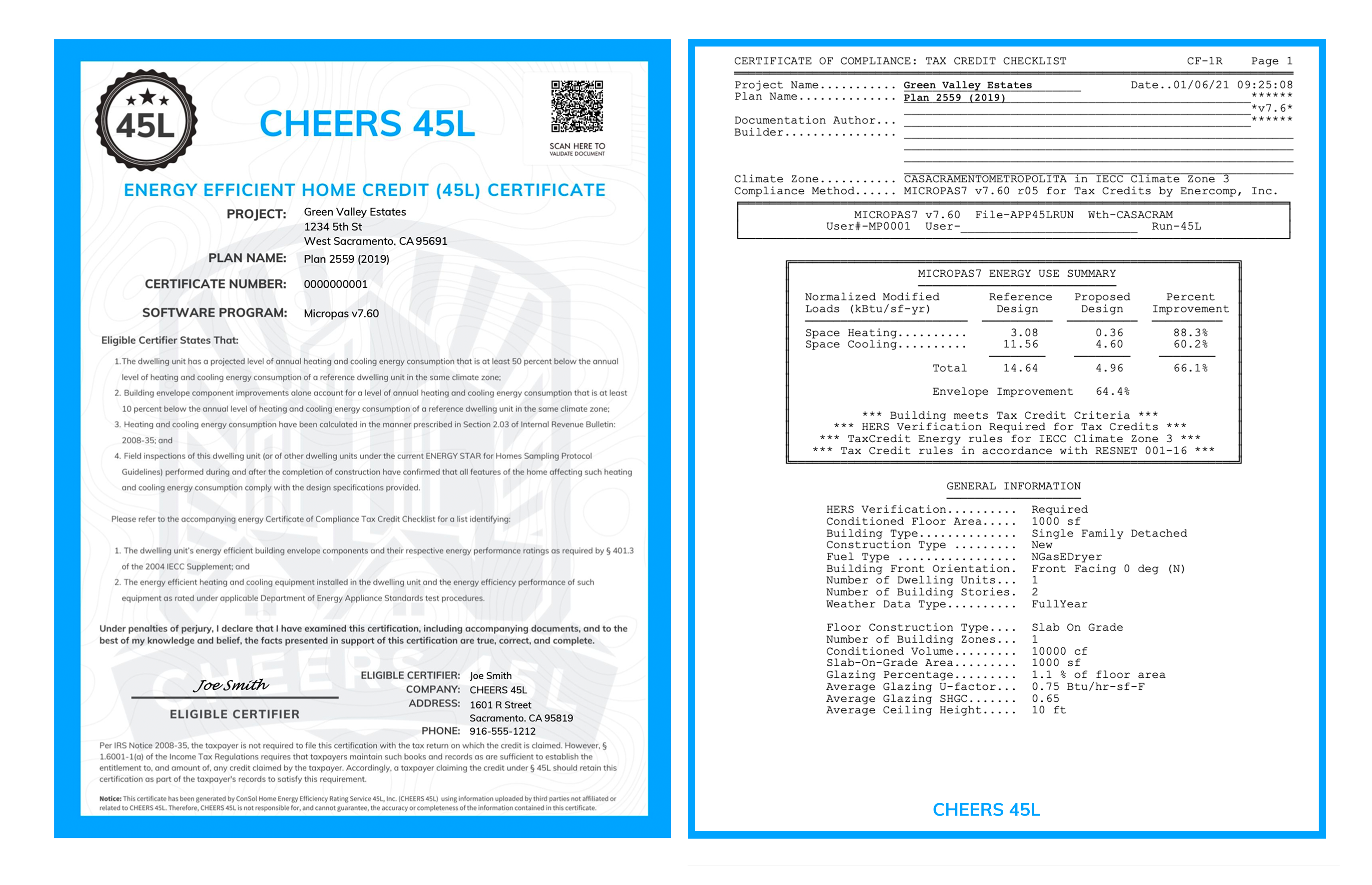

To claim the 45L tax credit the property must meet the following criteria.

. The incentive applies to single-family homes as well as condominiums apartment complexes. An 85 unit assisted living. The 45L Tax Credit allows owners and developers of single and multi-unit residential properties including assisted living facilities to claim credits for newly constructed or renovated.

Claiming Energy efficient 45L tax credit using 8908 form for a new fourplex construciton I have a new fourplex built and leased in 2019. If you are a developer that has built a low-rise multifamily property the 45L tax credit could benefit your company. 2 Form Any certification described in subsection c shall be made in writing in a manner which specifies in readily verifiable fashion the energy efficient building envelope.

Under the American Taxpayer. The credit is taken on tax form 8908. The Code Section 45L credit is the applicable amount for each qualified new energy efficient home which is constructed by an eligible contractor and acquired by a person.

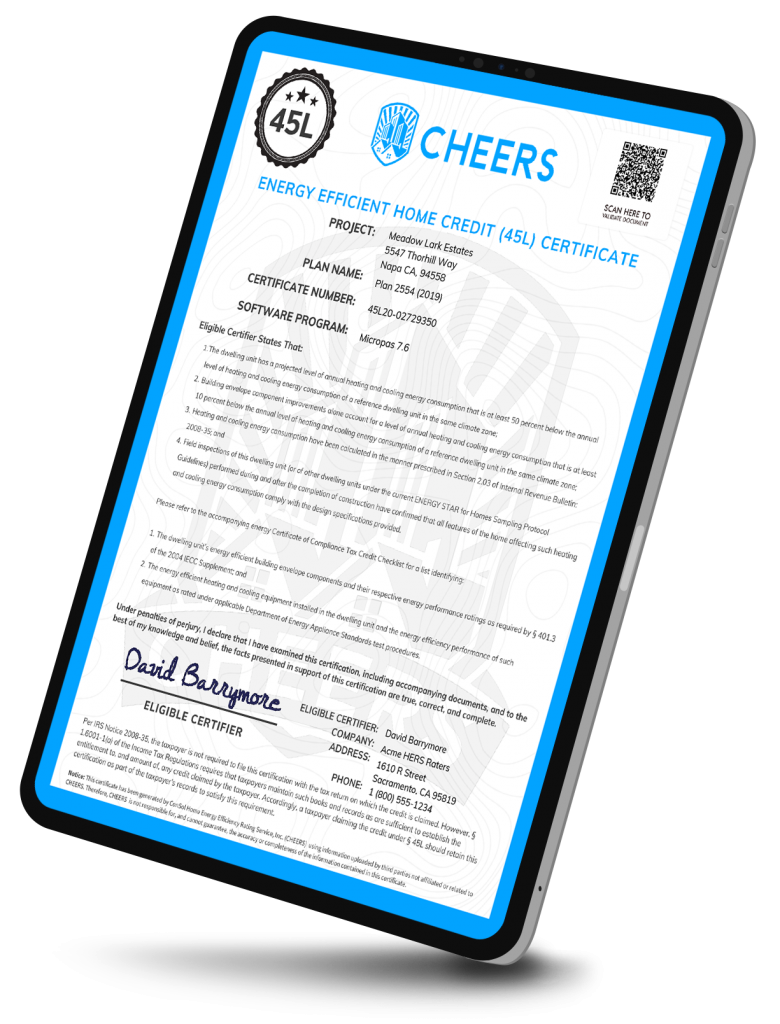

In order to claim the credit a licensed third-party through must conduct on-site testing and energy modeling to produce a certification package. The 45L credit not only includes new construction but reconstruction and rehabilitation projects. Eligible contractors use Form 8908 to.

Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. Recent tax legislation extended the Energy Efficient Home Credit to developers of energy-efficient homes and apartment buildings. A key requirement of the tax credit is the sale close of escrow or lease executed leaserental agreement of the home or dwelling units during the taxable year the credit is.

The 45L tax credit is a provision under the Internal Revenue code that allows owners of energy efficient residential buildings to receive substantial tax benefits. The 45L Tax Credit originally made effective on 112006. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year.

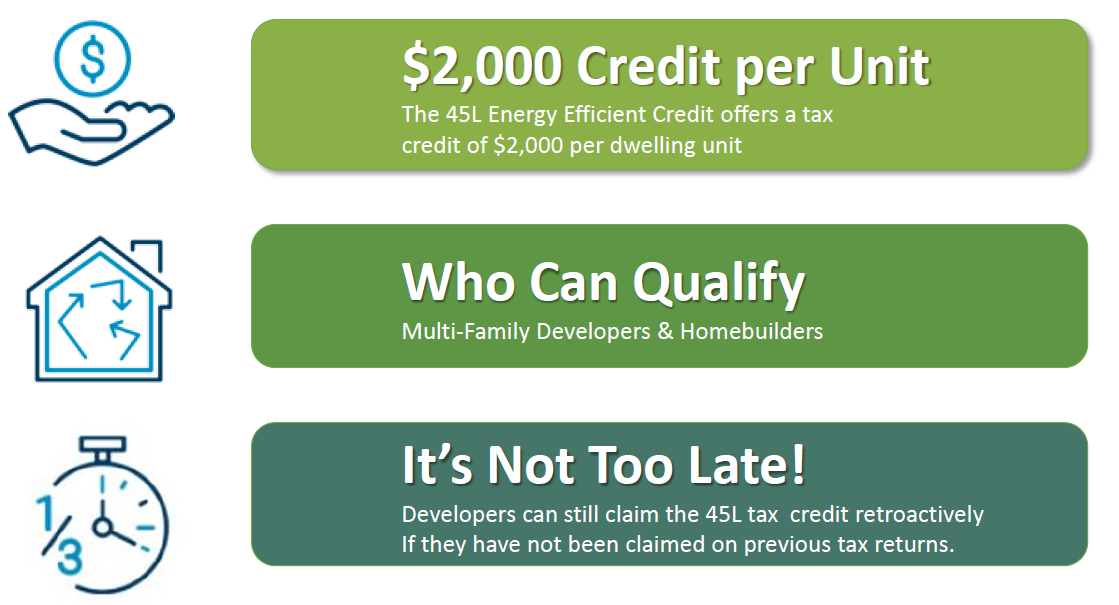

The credit is reported on IRS Form 8908 Energy Efficient Home Credit. Section 45L provides a credit to an eligible contractor who constructs a qualified new energy efficient home. The Internal Revenue Code IRC Section 45L is a 2000 per dwelling unit 1000 for manufactured homes tax credit for each new energy-efficient home which is constructed by.

A key requirement of the tax credit is the sale close of escrow or lease executed leaserental agreement of the home or dwelling units during the taxable year the credit is claimed. Once the certifier has provided you with all the certifications you need you will have to use IRS Form 8908 Energy Efficient Home Credit to file for the 45L tax credit. The credit is a general business credit that can offset tax dollar for dollar.

How will Section 45L Affect My Tax Return. Enter total energy efficient home. Find out if you have qualified for this unique tax credit by.

I am currently getting the. The 45L tax credit allows taxpayers to claim potentially significant credits for the construction of new energy-efficient homes. Units homes leased up or sold in an open tax year generally the last 3 years.

Through recent passage of a new tax extenders bill the energy efficient home credit the 45L credit which provides eligible contractors with a 2000 tax credit for each. Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. How do you know if your.

The 45L Tax Credit is available for Builders who have financed the construction of energy efficient homes and then leased or sold them. For qualified new energy efficient homes other than manufactured homes the. The 45L tax credit for energy-efficient homes provides 2000 per unit for owner-occupied or rental dwelling buildings that meet certain qualifications.

The 45L credit which previously was set to expire on December 31 2020 allows the eligible contractor of a qualified new energy-efficient dwelling unit a 2000 tax credit in. The developer would be eligible for 600000 in 45L credits in 2019 and 200000 in 45L credits in 2020. THE 45L ENERGY EFFICIENT HOME CREDIT Currently the 45L Credit allows eligible developers to claim a 2000 tax credit for each newly constructed or substantially reconstructed qualifying.

And you could receive a 2000 per unit tax credit. The 45L credit is claimed on IRS Form 8908. Energy credit part of the investment tax credit must not again be considered in determining the energy efficient home credit.

The tax credit was retroactively extended from.

2021 Available Tax Incentives For Energy Efficiency Cova Green Homes

Paparazzi Accessories Taxes Info Paparazzi Paparazzi Fashion Paparazzi Jewelry Displays

Dpis Builder Services 45l Energy Efficiency Tax Credit

179d Tax Deductions 45l Tax Credits Source Advisors

45l Tax Credit Services Using Doe Approved Software

Green Building That Saves You Big Bucks With 45l Tax Credit Benefits Income Tax Tax Preparation Tax Deductions

The 45l Tax Credit Is Expiring Again Cheers 45l

How Does The 45l Tax Credit Work Energy Diagnostic

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

Account Receivable Funding Http Www Africanewswire Net Story Php Title Interstate Capital And Your Business Invoicing Business Financial Services

The Home Builders Energy Efficient Tax Credit An Faq

45l Tax Credit Services Using Doe Approved Software

What Did We Learn From The Paradise Papers Paper Learning Paradise